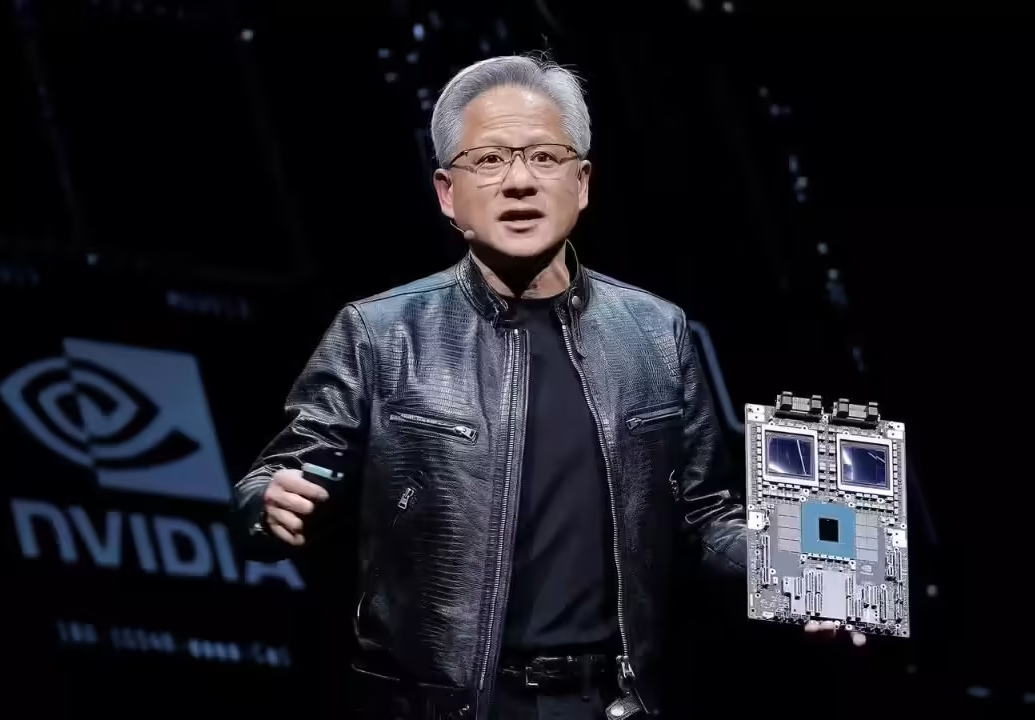

SANTA CLARA, 29 October 2025 – At a high-profile company event in Washington, Huang addressed investor concerns over a potential artificial-intelligence investment bubble, while unveiling his firm’s belief that new AI infrastructure demand will drive sustained growth.

What Huang Said

Huang stated that the company’s latest flagship AI accelerators, across the “Blackwell” and “Rubin” chip families, are on track to generate roughly US$0.5 trillion in revenue, underscoring strong demand rather than speculative excess. He emphasised that the firm has entered a “virtuous cycle” of chip deployment, and asserted that the AI industry is transitioning into the infrastructure phase rather than mere hype.

Using Partnerships to Back the Case

To support the outlook, Nvidia announced new strategic alliances across cloud, enterprise and telecom sectors, designed to expand the AI compute ecosystem beyond hyperscalers into broader enterprise adoption. These partnerships aim to embed Nvidia’s chips and software across vertical use-cases, thus anchoring future demand.

Why it Matters for Asia and Investors

For Asian investors and regional tech developers, several take-aways emerge:

- Infrastructure-led growth: Huang’s argument shifts focus from speculative software applications to heavy-duty hardware infrastructure. That has implications for Asian chip supply-chains, manufacturing partners, and regional data-centre build-outs.

- Valuation risk versus fundamental demand: Markets have raised bubble alarms (see alerts from the International Monetary Fund and Bank of England); Huang’s presentation represents a pushback, aiming to reassure that demand is structural.

- Regional client base expansion: As the compute needs spread beyond U.S. hyperscalers, Asian cloud platforms, telecom operators and manufacturing hubs could benefit from off-the-shelf AI infrastructure deployments anchored by Nvidia’s roadmap.

- Geopolitical dimensions: The hardware-infrastructure narrative also has regional political and supply-chain resonance, especially as AI hardware becomes part of industrial policy agendas in Asia.

Risks and Watchpoints

While the bullish tone is clear, there are caveats to monitor:

- Execution of scale: Huang’s revenue targets depend on large-scale chip production, global supply-chain resilience, and enterprise uptake. Any bottleneck or demand softening could affect delivery.

- Valuation stretch: Investors might ask whether current multi-trillion-dollar opportunity claims are already priced in. Previous tech cycles warn of built-in optimism risk.

- Competition and diversification: With rising competitive pressure (e.g., from Advanced Micro Devices (AMD) and Intel Corporation), Nvidia will need to sustain its ecosystem advantage to maintain the growth trajectory.

Final Take

Huang’s message offers a counter-narrative to bubble warnings: he sees AI spending moving from optional to essential, prompting long-term infrastructure investment. For Asia’s tech-investor community, the question now shifts from “Is this a bubble?” to “Can Asia capture its slice of the infrastructure boom?”